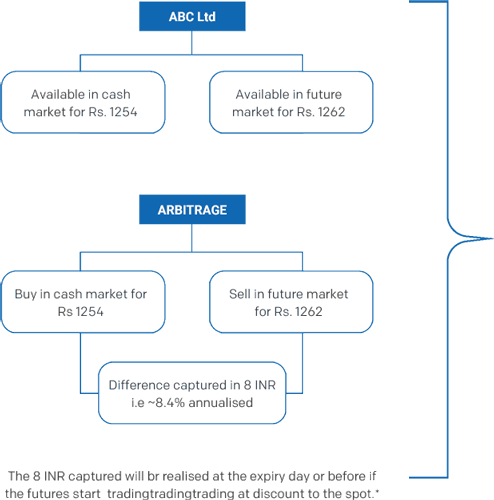

The simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms, to take advantage of differing prices for the same asset. This is considered risk-free profit for the investor/trader.

PAIR OF GLOVES IS PRICED AT RS. 10 IN MARKET A

PAIR OF GLOVES IS PRICED AT RS. 15 IN MARKET B

This trade is protected against any market movement as the long position is completely hedged with the Short position

Aim to earn returns at relatively lower risk

Get a Shield for your portfolio that can act as a hedge against volatility

Benefit from tax efficiency by availing tax treatment alike equity

Suitable for Investors:

| Scheme Name | TATA ARBITRAGE FUND |

| Type of Scheme | An open ended scheme investing in arbitrage opportunities |

| Investment Objective | The investment objective of the Scheme is to seek to generate reasonable returns by investing predominantly in arbitrage opportunities in the cash and derivatives segments of the equity markets and by investing balance in debt and money market instruments. |

| Fund Manager | Sailesh Jain |

| Benchmark | Nifty 50 Arbitrage Index |

| Min. Investment Amount | Rs. 5,000/- and in multiple of Re.1/- thereafter |

| Load Structure | Entry Load: Nil. Exit Load: 0.25 % of the applicable NAV, if redeemed/ switched out/withdrawn on or before expiry of 30 Days from the date of allotment. |

| Plans & Options | Regular & Direct Plans with Growth & Monthly Dividend Option (monthly dividend is not assured and is subject to the availability of the distributable surplus). |

RISK DISCLOSURES:

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051